President Obama likewise has actually been accused of crony commercialism in relation to his assistance for Solyndra, a failed company that concentrated on green energy innovation.

If you have a varied investment portfolio you’ve probably bought publicly traded stocks on the open market. However some investors run in an alternate, well-funded financial investment universe. In the world of private equity, well-funded financial investment companies make huge financial investments in private companies, typically with the objective of taking over those business and making them more successful (athletes sports agencies).

Sometimes the business is reputable and its owners have actually picked to retain overall control. It likewise may be a brand-new business that is not yet valuable sufficient to go public. In many cases, a group of investors will purchase all outstanding shares and eliminate a company from public exchanges, which is called de-listing.

They target business with great deals of potential; distressed companies with valuable properties; and other customized cases. If a private equity firm is doing the investing, it typically will have organisation management expertise in addition to deep pockets. These firms can take an active role in restructuring or simplifying a business before selling it for earnings.

Investors need plentiful resources to purchase in and pay top skill if they take a function in business management. They’re banking on potential worth in target companies, however in some cases the business do not end up being lucrative. So investors also require to diversify their investment dangers. Overall, investing in private equity requires deep pool of monetary and business resources.

Private equity firms are not passive investors. They typically buy 100% of a target company, or at least a managing stake, and may do a great deal of work to enhance its operations, cut expenses or improve efficiency. Likewise, they don’t play for keeps, since these firms buy into business to make a profit on their eventual sales and through management fees.

Some targeted companies require a financial increase to develop brand-new items or technology. Established business with lots of possessions and serious problems are other targets. In these cases, a private equity firm may purchase in and utilize its expertise to enhance performance and boost worth. It likewise might cut expenses or liquidate the business and sell remaining assets at a profit.

The firm borrows a part of the sale price from a 3rd party and pays it once it sells the target company. Private equity companies often are compared with equity capital investors, but there are crucial differences between them. Whether PE firms borrow or install their own money, they typically buy most or all of the target business (civil penalty $).

How To Answer “Why Private Equity” For Interviews – 10x Ebitda

Additionally, venture capital focuses on start-ups with strong development potential and developing ideas or products. PE firms for the a lot of part target underperforming business with longer track records. PE firms make most of their income through 2 channels: management fees and performance costs. The management cost is based on an evaluation of the company’s value and is not tied to efficiency (that is, firms collect no matter how the business is doing or what it’s worth).

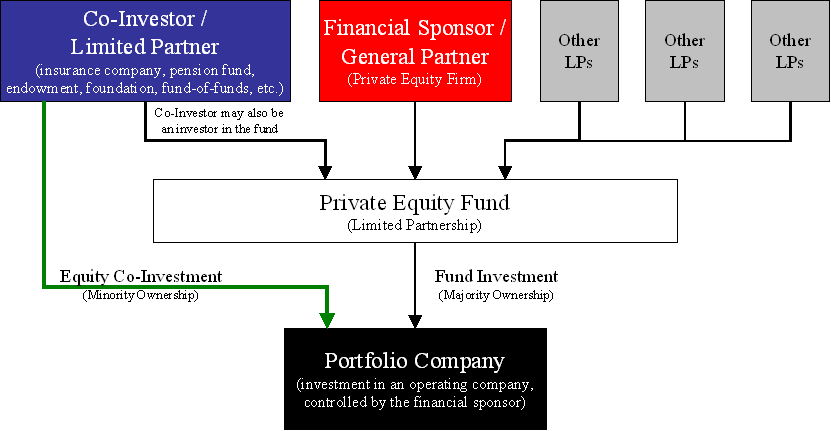

20% performance charges are common, although they differ. Management charges can run between zero and 3%. Existing research suggests the average is around 1.5% Many private equity funds have basic partners and restricted partners. General partners choose the financial investments and form the brain trust. It’s their business competence that guides the restructuring or enhancement of the target business.

You likewise can buy stock in a service development company. A lot of are business on public exchanges that look for growing or struggling companies with great deals of possible worth. Just like real private equity companies, the majority of these options have charges for management and efficiency, but they bypass the steep entry requirements.

Specific funds can have their own timelines, investment objectives, and management philosophies that separate them from other funds held within the same, overarching management firm. Successful private equity firms will raise lots of funds over their life time, and as firms grow in size and complexity, their funds can grow in frequency, scale and even uniqueness.

Prior to founding Freedom Factory, Tyler Tysdal managed a growth equity fund in association with numerous celebs in sports and home entertainment. Portfolio company Leesa.com grew rapidly to over $100 million in profits and has a visionary social objective to “end bedlessness” by donating one bed mattress for each 10 sold, with over 35,000 contributions now made. Some other portfolio companies remained in the markets of red wine importing, specialized lending and software-as-services digital signs. In parallel to handling assets for businesses, Tyler was managing private equity in real estate. He has had a variety of effective private equity financial investments and a number of exits in trainee real estate, multi-unit real estate, and hotels in Manhattan and Seattle.

For the many part, private equity attract severe and knowledgeable investors. It frequently requires a great deal of money in advance and can carry considerable danger, which is why private equity funds spread their capital across many financial investment opportunities. Ambitious investors with ways can invest with a PE firm directly, through participation in a bigger fund or by buying the stock of significant funds.

While the high-stakes, high-dollar world of PE may not be practical for you, a financial advisor can assist you created a more standard investing strategy. SmartAsset’s totally free tool matches you with monetary consultants in your location in 5 minutes. If you’re prepared to be matched with regional advisors that will help you attain your financial goals, start now.

Make the most of Smart Possession’s Investment Calculator to much better picture your goals and preferences. Image credit: iStock. grant carter obtained.com/ Jirapong Manustrong, iStock.com/ PeopleImages, iStock.com/ Chalirmpoj Pimpisarn.